China’s official growth figures are bad enough to be believed

We cross-check the latest numbers

When china’s Politburo, the 25-member committee that oversees the Communist Party, met this time last year to ponder the economy, China’s rulers seemed quite confident. Their annual growth target was in easy reach and they were keen to crack down further on the country’s overstretched property developers. As The Economist went to press, the Politburo was preparing to meet again. But the economy looks quite different. China’s attempts to stamp out any outbreak of covid-19 have crippled manufacturing intermittently, and consumption more persistently. Distressed developers have stopped working on pre-sold flats—and aggrieved homebuyers have refused to pay their mortgages until construction resumes.

This has put China’s rulers in a pickle. They seem determined to stick to their zero-covid policy. And they would no doubt love to cling to their official gdp growth target of “around 5.5%”. But it has become clear they cannot do both. Unless, of course, they fiddle the growth figures.

This article appeared in the Finance & economics section of the print edition under the headline “Less growth, more credibility”

More from Finance & economics

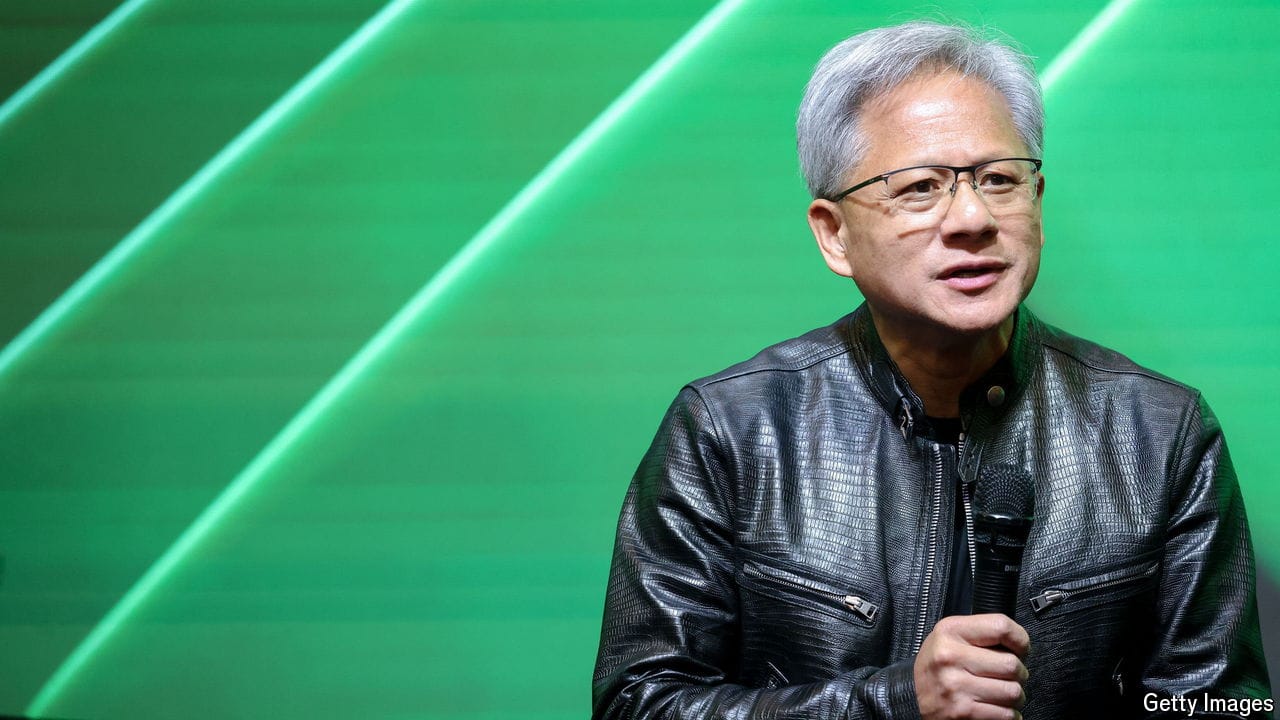

Think Nvidia looks dear? American shares could get pricier still

Investors are willing to follow whichever narrative paints the rosiest picture

How bad could things get in France?

The country’s next prime minister faces a brutal fiscal crunch

Why house prices are surging once again

In America, Australia and parts of Europe, property markets have shrugged off higher interest rates