05/28/2024

Blog

The convenience and prevalence of online transactions comes with many risks, none more so than new account creation fraud. This type of fraud is the nexus of various identity theft schemes, including data breaches, consumer scams and social engineering. Powered by unprecedented levels of identity theft activity, criminals are exploiting new account creation for financial gain by:

Not only does this cause significant financial and credit history harm to individuals whose identities are compromised, new account creation fraud leads to financial and reputational losses for organizations. It’s a major challenge as it often goes undetected until is has inflicted substantial financial damage. Combating it requires investment in stronger identity risk signals and proactive tools to streamline identity verification at the point of new account creation.

New account creation fraud, often referred to as "account origination fraud" or “new account fraud (NAF),” occurs when someone uses stolen or fabricated personal information to create a new account, typically with a financial institution, retailer or service provider. Often initiated via a scam or personal information obtained from a data breach, this type of fraud can involve various forms of identity theft. For instance, a fraudster may use a person's genuine details without their knowledge, or they may combine stolen identity elements like names, addresses and Social Security numbers to create completely synthetic identities.

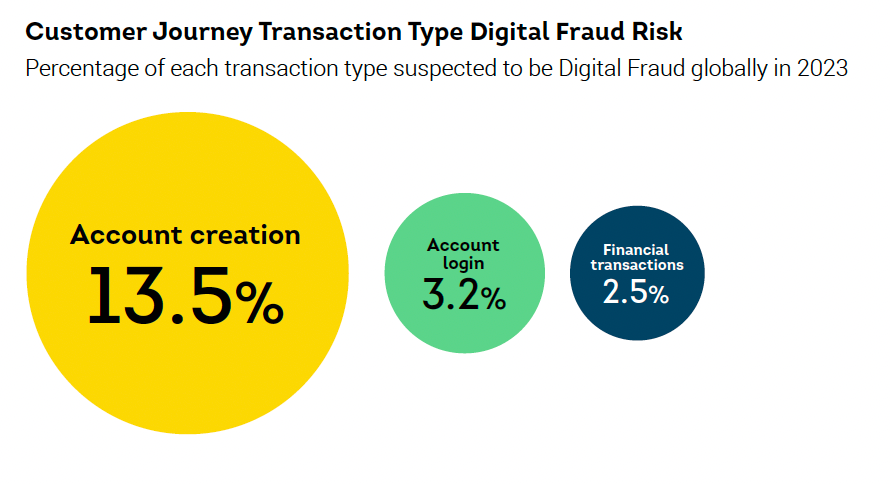

According to TransUnion’s recent 2024 State of Omnichannel Fraud Report, an alarming 13.5% (or 1 in 7) of all newly created accounts last year were suspected to be fraudulent, making it the riskiest step in the customer journey.

Customer journey stages defined

This significant percentage of suspected Digital Fraud was more than four times higher than account login, typically leading to ATO fraud, and more than five times higher than financial transactions where money was exchanged.

The cost of new account creation fraud varies by industry, but it’s a multibillion-dollar problem for businesses and consumers alike. According to Javelin’s 2024 Identity Fraud Study, “The number of victims of new-account fraud (NAF) dropped 10% to 3.2 million adults. Despite fewer affected consumers, the overall cost to NAF victims increased 35% to $5.3 billion in 2023. Javelin analysts believe this inverse relationship is representative of a shift in criminal tactics triggered by stronger identity verification and authentication standards. Cybercriminals aren’t simply searching for low-hanging fruit and opening as many accounts as possible. Instead, criminals who are able to bypass authentication measures strive for larger payouts with each successful attempt.”

Synthetic identity fraud exposure is a $3 billion problem in financial services — and the fastest growing digital fraud as measured by TransUnion. As mentioned, in this scheme, criminals combine stolen or harvested identity data with other fictitious data to create completely fabricated synthetic identities. They use credit account holders or financial institutions to establish legitimacy for a synthetic identity by building credit history — enabling a fake identity to look and act like a real person. With a legitimized synthetic identity and access to credit in-hand, criminals can attack any organization and walk away with money, merchandise or services at will.

In an industry like telecommunications and technology, criminals use synthetic identities to commit subscription fraud tied to installment plans for mobile handsets and devices. In 2021, the Communications Fraud Control Association (CFCA) estimated handset/device-related fraud to be $10.8 billion or 27% of all fraud losses. Of that total, CFCA estimated $2 billion was related to subscription application fraud.

New account creation fraud enables criminals to ultimately perform account takeovers and directly control accounts for a variety of reasons from accessing credit to opening mule accounts within financial institutions to opening many accounts to commit promotion abuse within gaming and retail.

New account creation fraud is challenging because unlike many types of fraud, there are degrees of acceptable risk when acquiring new customers — a primary objective for most organizations. A retailer may be willing to live with a certain level of promotion abuse if it means more sales. On the other hand, credit card fraud is completely unacceptable due to chargeback costs and the financial impact on the legitimate card holder. Online commerce platforms look for constant growth in users and a seamless customer experience that can lead to the creation of fake accounts. But, they also depend on trust to keep customers engaged and have little tolerance for third-party seller scams occurring on their platforms.

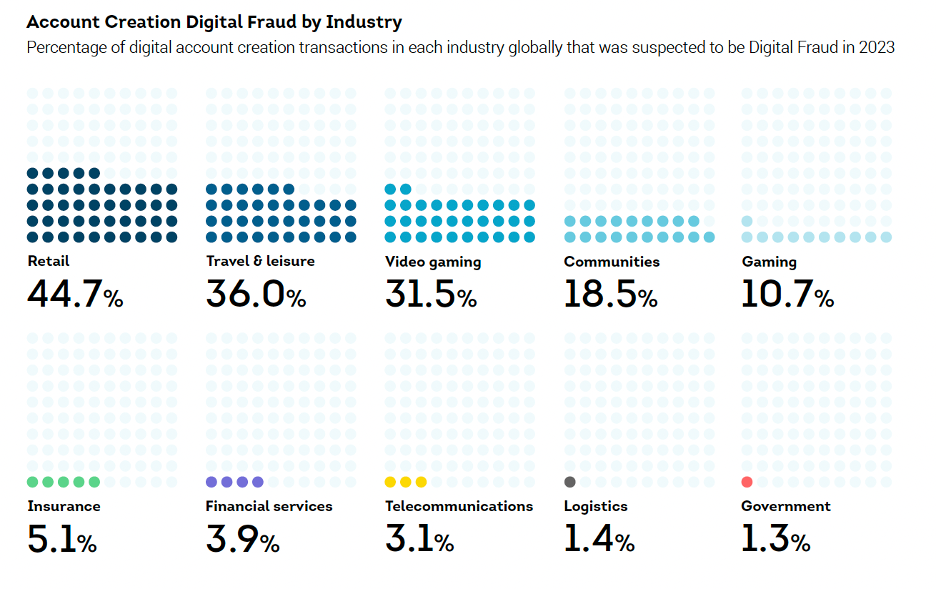

The Omnichannel Fraud Report outlined the percentage of digital account creation transactions in each industry that was suspected Digital Fraud in 2023. The industries with more than 30% of digital new account creation transactions suspected to be Digital Fraud share similar characteristics: high transaction volumes, highly promotional marketing to attract new customers, and minimal identity verification process for new account creation.

Retail leads all industries in new account creation fraud risk. About 45% of new digital retail account creations were risky in 2023, meaning some part of the identity used to create an account was fake or falsified. But the issue isn’t unique to retail, travel and leisure and gaming also saw more than 30% of new account creation transactions as suspected Digital Fraud in 2023.

Despite 59% of consumers indicating additional security measures make them more likely to shop a particular brand, according to TransUnion’s 2023 Holiday Shopping Report, many organizations are willing to prioritize sales and convenience over fraud prevention through these common practices:

When considering how to bolster protection from new account creation fraud, the financial services industry offers a solid track record with the lowest number of suspicious new account creation transactions at 3.9% in 2023. That could serve as a benchmark other industries strive to match. Some of the best practices developed by financial services could be adopted broadly to protect organizations in other industries:

1. Borrow components from regulatory best practices: Stringent identity verification regulations like know your customer (KYC) in the financial services industry provide more protection for consumers and help prevent fraud. Even if an industry is not required to adhere to a regulation, it can be beneficial for organizations to seek solutions that support identity verification, KYC, document verification or device-proofing to improve confidence in new accounts.

2. Use more sophisticated fraud tools: Advanced security measures, such as biometric authentication, multi-factor authentication (MFA) and synthetic fraud detection, provide additional layers of identity verification. Incorporate advanced features like MFA or synthetic fraud models into new account opening protocols.

3. Implement sophisticated risk mitigation strategies: Multilayered risk assessment tools and models help detect potentially fraudulent activities, as well as suspicious patterns and behaviors to protect consumers and their organizations. Add more sophisticated fraud detection signals like device-to-identity linkages, email and phone verification, and device-proofing to drive smarter step-up challenges during new account opening.

4. Establish reputation and trust as key brand values: Consumers value more protection against fraud, and financial institutes must act accordingly. Prioritize account security and fraud prevention to establish and maintain customer trust and credibility in your brand.

Many industries have higher levels of suspected fraud than financial services at new account creation due to conflicting business goals, customer experience realities, and limited ability or requirement to invest in more sophisticated fraud prevention strategies.

However, to detect, identify and mitigate costly impacts of new account opening fraud, organizations across all industries need to access more relevant risk signals that can help them better assess fraud at this earlier stage in the customer lifecycle.

Learn how TransUnion can help mitigate new account creation fraud risk TruValidate™ identity and fraud solutions.