The evolution of AI in the insurance industry

Article information and share options

From rule-based algorithms to new machine learning-based AI, this blog explores the dynamic nature of AI and what this means for insurance industry.

Have you ever come across a definition of Artificial Intelligence (AI) that explains the topic in a succinct, understandable way? One way I explain AI to friends and family is: Artificial Intelligence helps computers mimic human actions to solve problems and accomplish tasks more efficiently.

In the business context, it is essential to articulate the capabilities of AI with precision and acknowledge its dynamic nature. In the early days of automation, the insurance industry utilised systems grounded in rule-based algorithms, facilitating processes such as underwriting, risk assessment, and claims management. However, they required considerable manual input for development and upkeep, reflecting the lack of autonomous learning and adaptivity.

The excitement in the industry today is centred machine learning-based AI. This advanced form of AI is characterised by its ability to train extensive datasets to recognise patterns and make predictions or decisions autonomously, without task-specific programming. However, currently this type of AI is mostly used for narrow, task-specific applications such as classifying submissions and claims.

Like many, I am intrigued by Generative AI, a subset of modern AI and its remarkable ability to create novel content such as text, images, music, or intricate designs. It achieves this by learning the patterns in its training data, thereby generating new data. Regardless of how AI evolves, it's crucial that humans always have full control of the decision-making and that potential risks posed by AI are mitigated.

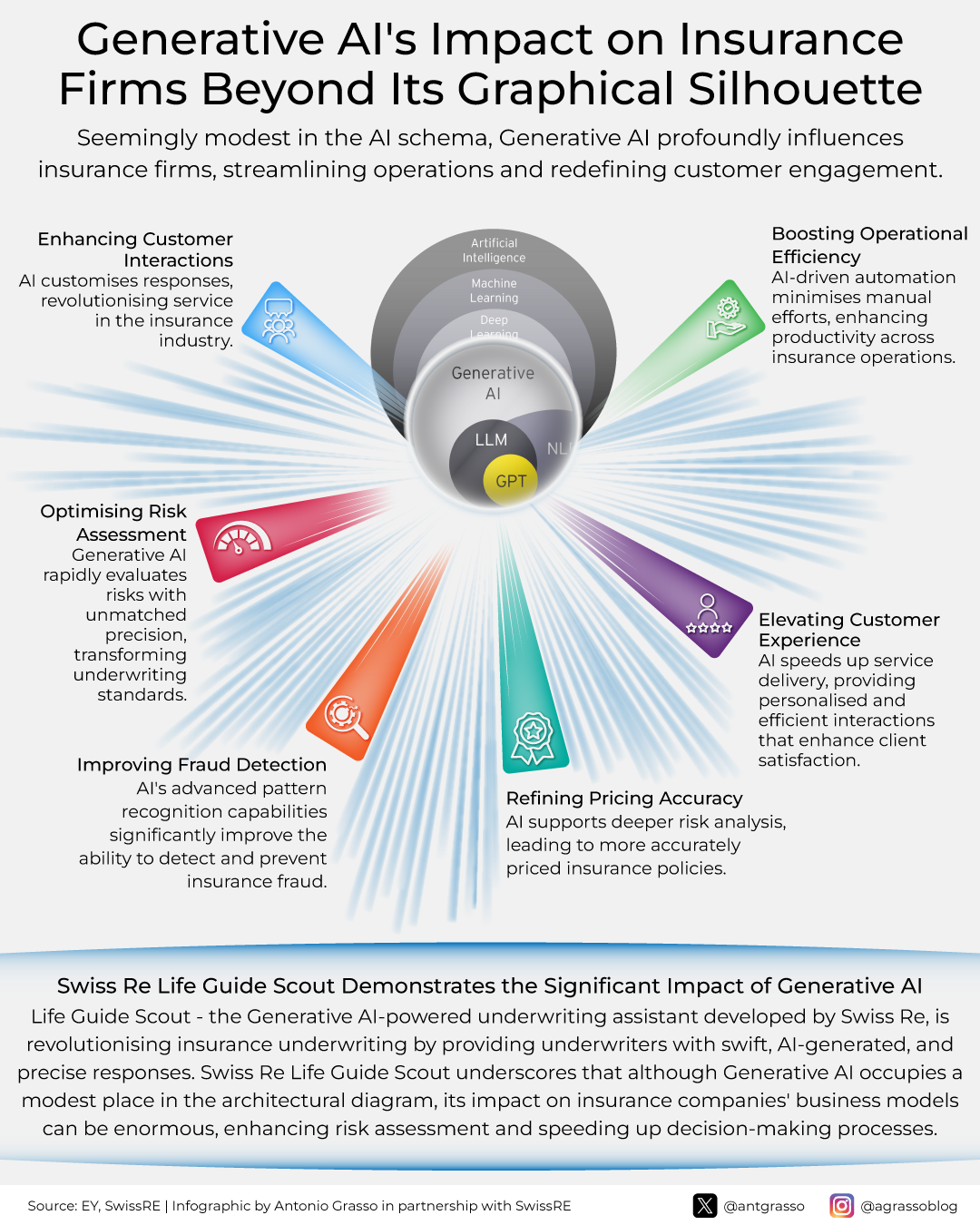

Generative AI's impact on Insurance Firms

Artificial Intelligence can improve over time

A helpful definition of AI when talking to stakeholders is the OECD's, it also captures recent forms of AI like Generative AI.

OECD: "An AI system is a machine-based system that, for explicit or implicit objectives, infers, from the input it receives, how to generate outputs such as predictions, content, recommendations, or decisions that can influence physical or virtual environments. Different AI systems vary in their levels of autonomy and adaptiveness after deployment."

In the context of insurance, modern AI techniques like machine learning and deep learning can be used for tasks such as predictive modelling, fraud detection, and customer service automation. These systems can often achieve higher levels of accuracy and efficiency compared to traditional rule-based approaches, and they have the potential to continuously improve over time as they are exposed to more data.

Generative AI insurance use case for underwriting

The augmented version of Swiss Re's Life Guide, the world's number one Life & Health underwriting manual, capitalises on these capabilities. It is now piloting Swiss Re Life Guide Scout, a Generative AI powered assistant, that supports underwriters in speeding up risk assessment and unlocks insights for improved human decision making. It also allows them to make professional queries, receiving an AI-generated answer and the source of information, within seconds.

The Generative AI powered chat bot improves the efficiency and quality of underwriting by generating swift, reliable answers compiled from curated expert knowledge in response to questions asked by the underwriter in natural language. This enables them to make faster, more precise underwriting decisions, as well as accelerated and improved knowledge transfer. The Generative AI-powered underwriting assistant, developed by Swiss Re, integrates Microsoft Azure OpenAI Service that provides access to the world's leading Large Language Models (LLMs).

Advanced AI has the potential to increase business efficiency, improve interaction with customers, and innovate products and solutions. The real benefit of AI is not the technology itself but comes from the smart combination of both AI models and human processes. It's also key for businesses to clearly explain to their stakeholders how they use AI to build trust in the digital world.

Understanding what AI is, is crucial because it's more than just a tool—it requires a complete strategy to ensure it's trustworthy. As AI continues to develop, its definition will also evolve.