Over 30 years of expertise

Boosting transparency in public and private markets for over 30 years with the acquisition of the Burgiss Group.

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Featured

Data-driven decisions for dynamic times

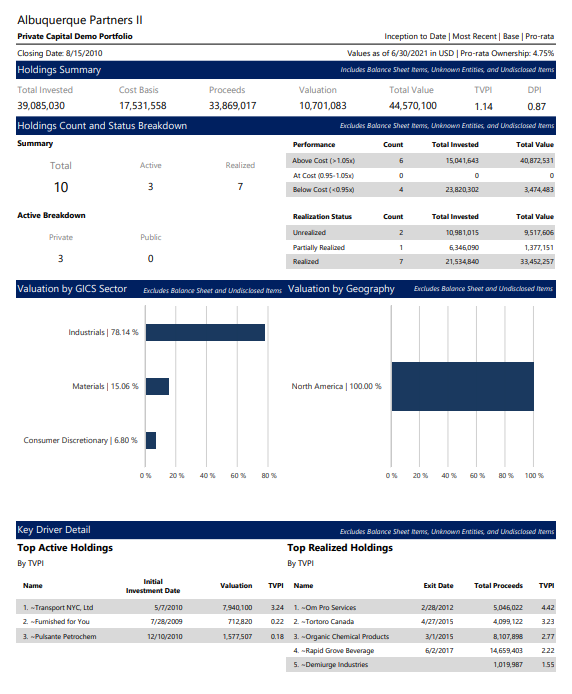

Gain a panoramic view into the holdings of your private capital investments

Navigate this opaque asset class with confidence with the private capital dataset that is MSCI-enriched with research-based insights. Data is continuously gathered from original source documents provided by managers, augmented with extensive research, and uniformly classified and checked.

5,350Managers

20,700Funds

450,000Fund investments1

Leverage one of the world’s largest universe of funds with extensive coverage of historical performance data and cash flow profiles enriched for better accuracy and granularity.

Rely on our 30 years of disciplined data management processes and dedicated team of 350 specialists who aim to ensure the highest standards of data integrity and security.2

Access data effortlessly through the Private i® platform or integrate into Total Plan (formerly Caissa), BarraOne, RiskManager or third-party programs for analytics at your fingertips.

Identify drifts from stated investment strategies, track direct and indirect investments and take climate and sustainability into account across unlisted asset classes.

Understand underlying drivers from fund to individual holdings with intuitive dashboards for informed decision-making.

Monitor positions, quantify concentration by asset class, sector, or geography, and manage risk with detailed look-through analysis.

LPs such as sovereign wealth funds, public and corporate pensions, endowments, foundations, insurance companies and family offices need a holistic view of their private capital portfolios. They also need the ability to monitor managers and funds to make more informed investment decisions, report to boards and stakeholders with greater confidence and operate efficiently.

General partners (GPs) need to measure exposure, underlying performance drivers and macro investment/divestment activity to optimize portfolios.

Fund-of-funds managers, asset managers, and advisers (both limited and general partners) who oversee diversified portfolios, need to monitor underlying holdings, identify trends and enhance decision-making.

Boosting transparency in public and private markets for over 30 years with the acquisition of the Burgiss Group.

The big picture across the private capital landscape augmented by risk, climate, ESG and other pioneering datasets.

The world’s largest pools of capital turn to MSCI for data and tools to inform their critical investment decisions.3

Gain insight into climate risk for the private assets in your portfolio. Measure exposure to emissions for 50,000 private companies and 6,000 private funds.

Get the latest trends delivered straight to your inbox.

Subscribe