"There is still much to do": The world has a critical minerals problem

- Andrew Freedman, author ofAxios Generate

The current dynamics of a well-supplied market in critical minerals are a poor guide to the future, an exhaustive new report finds.

Why it matters: These inputs are vital to producing renewable energy and powering electric vehicles. And an International Energy Agency analysis finds that while supplies of critical minerals have so far outpaced demand, sharp increases in production are needed to facilitate Paris climate targets.

- In addition, the report calls out increasingly vulnerable supply chains, with diversifying production of many critical minerals amid highly concentrated control of key industrial processes in China.

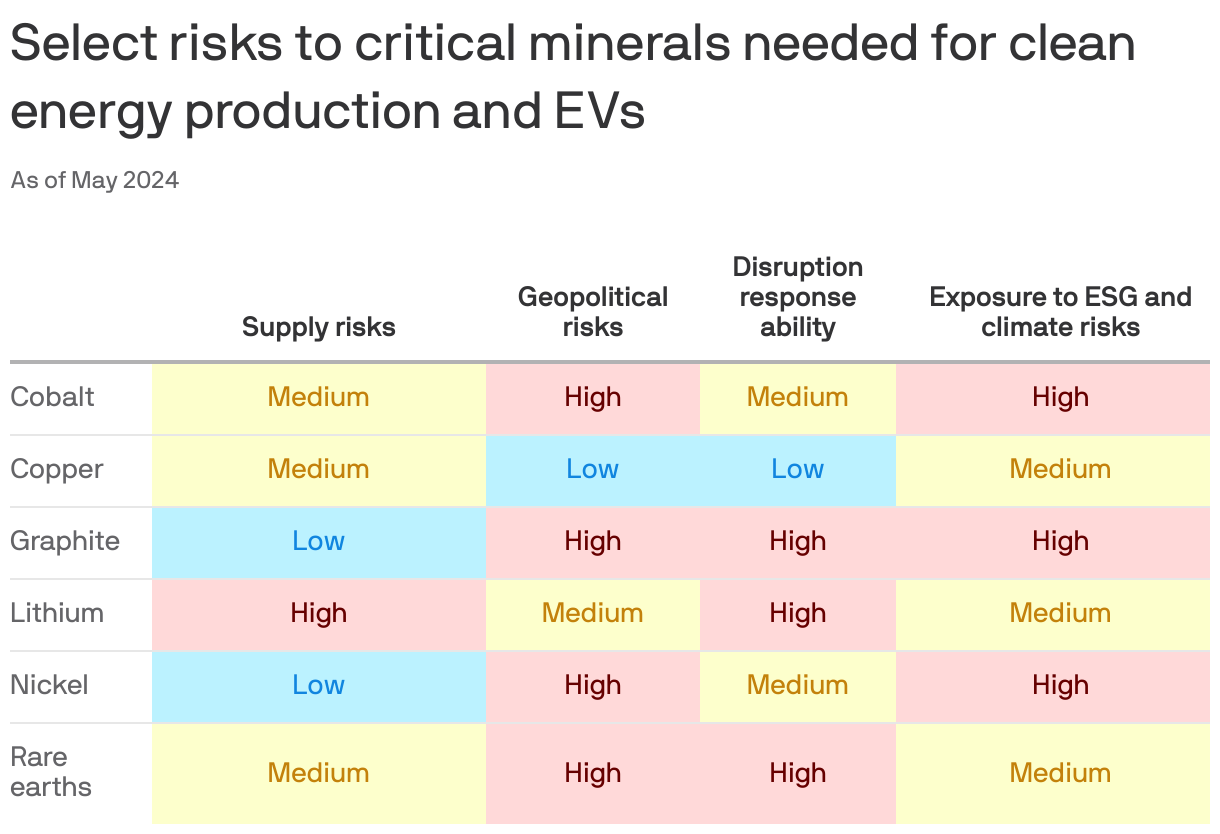

Zoom in: The IEA examines the nitty gritty details of an energy topic du jour: the increasingly thirsty demand for critical minerals like lithium, copper, nickel, cobalt, graphite and rare earth metals that power the "clean" energy economy.

- It contains sobering details about future needs and the concentration of production and recycling facilities, along with novel analyses of market dynamics to date.

- For example, the price of many critical minerals and rare earths fell in 2023, with a 75% drop in lithium prices; meanwhile, cobalt, nickel and graphite dropped between 30% and 45%, helping to drive down battery costs.

- At the same time, the lower prices have discouraged some investors in this space, with critical minerals mining investments growing by 10% and exploration spending by 15%, both below 2022 levels.

Stunning stat: China's spending on and purchase of overseas mines reached a record high of $10 billion in the first half of 2023, the report finds, with a focus on lithium (used in EVs) along with nickel and cobalt.

By the numbers: Each IEA scenario presented in the report, including the net zero scenario that would meet Paris Agreement targets, would require a drastic scale-up in critical minerals production.

- For example, the current market size of all key energy transition minerals would need to more than double, to $770 billion by 2040, to be on a net-zero pathway by 2050.

- The IEA's detailed project-level analysis shows that announced critical mineral projects would only meet about 70% of copper (used in electrical systems) and 50% of lithium requirements in 2035, in a scenario in which countries were to meet the climate goals they have already stated.

Between the lines: Critical mineral mining, refining, processing and recycling is concentrated in China and only a few other countries. That undercurrent runs throughout the report.

- It is also a key contributor to geopolitical risk, given tense relations with the U.S. in particular.

- Greater market concentration also makes critical mineral supply chains vulnerable to other types of disruptions, such as extreme weather events.

What they're saying: "The recent critical mineral investment boom has been encouraging, and the world is in a better position now than it was a few years ago, when we first flagged this issue," IEA executive director Fatih Birol said in a statement.

- "But this new IEA analysis highlights that there is still much to do to ensure resilient and diversified supply."